NQF Level:

Credits:

Minimum Duration:

Faculty:

Department:

Accreditation Authority:

Why Choose This Qualification?

Admission Requirements.

- National Senior Certificate (NSC): Endorsed for admission to Higher Certificate, Diploma, or Degree programs.

- National Certificate Vocational (NCV): NQF Level 4.

- Recognition of Prior Learning (RPL): Available to recognize your previous learning.

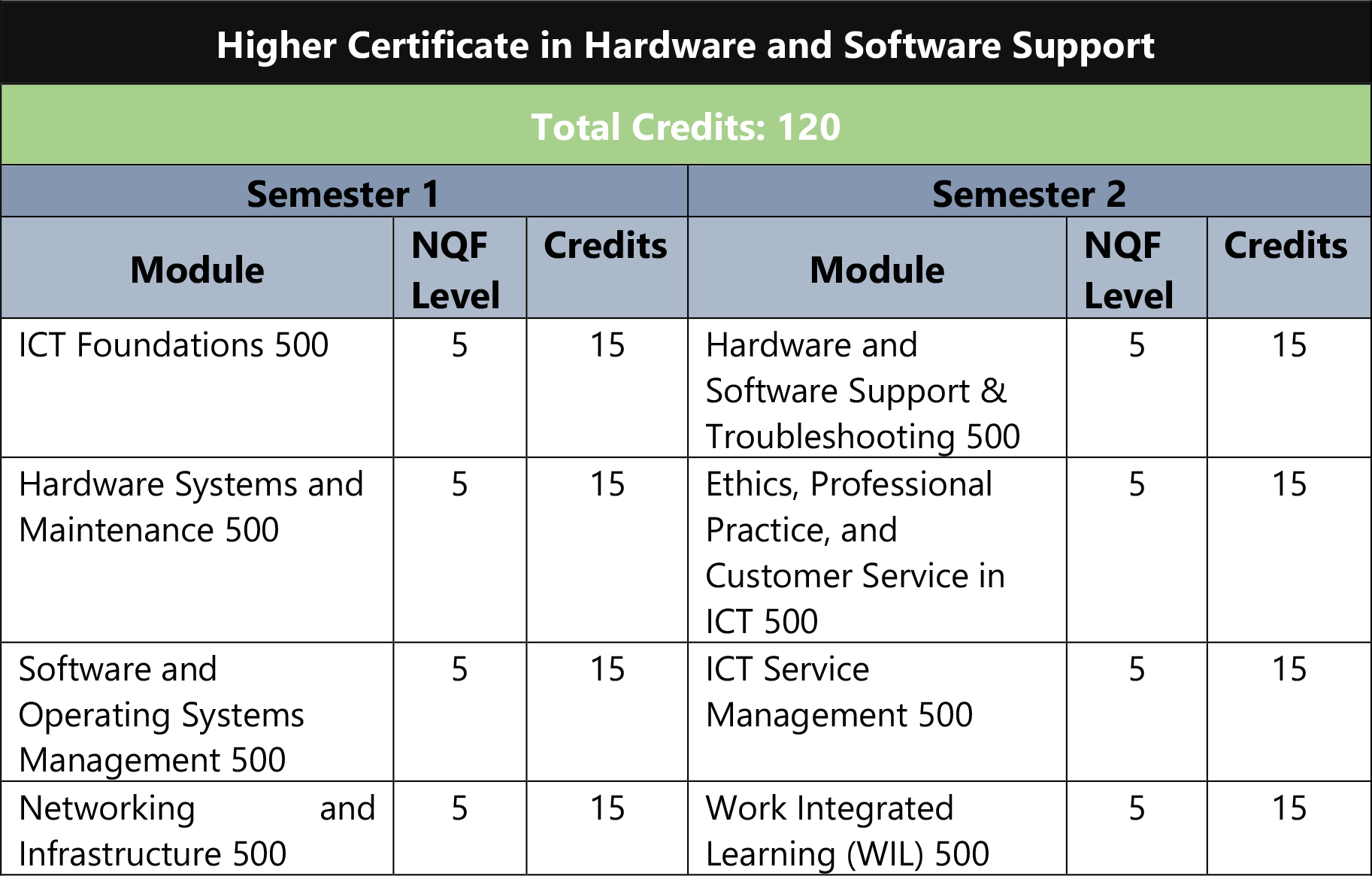

Qualification Structure.

Semester 1:

- ICT Foundations 500

- Hardware Systems and Maintenance 500

- Software and Operating Systems Management 500

- Networking and Infrastructure 500

Semester 2:

- Hardware and Software Support and Troubleshooting 500

- Ethics, Professional Practice, and Customer Service in ICT 500

- ICT Service Management 500

- Work Integrated Learning (WIL) 500

Learning Outcomes.

- Diagnose and resolve hardware and software issues effectively.

- Manage IT infrastructure with a focus on network solutions and security.

- Provide high-quality customer support by communicating technical information clearly.

- Implement cybersecurity measures to safeguard IT systems.

- Adapt to emerging technologies in the rapidly evolving ICT sector.

International Comparability.

Qualification Modes of Delivery and Support.

- Contact Learning: In-person engagement with industry experts.

- Blended Learning: A mix of interactive online and face-to-face sessions.

- Distance Learning: Study anytime, anywhere with access to AIFT’s Moodle LMS.

Career Opportunities.

- IT Support Technician

- Helpdesk Technician

- Network Support Technician

- Junior Systems Administrator

- Field Service Technician

Articulation Options.

- Vertical: Diploma in Information Technology (NQF Level 6)

- Advanced Certificate in Information Technology (NQF Level 6)

- Bachelor’s Degree in Computer Science (NQF Level 7)

Ensure Compliance, Empower Financial Accuracy.

With the Occupational Certificate in Tax Technology, you’re not just earning a qualification—you’re stepping into a crucial role in maintaining tax compliance and supporting financial accuracy. Gain the expertise to manage tax calculations, ensure VAT and payroll compliance, and navigate complex tax regulations with confidence.

Don’t wait to become an essential part of the financial sector.

Enroll today and build a career where you secure financial integrity and guide clients with precision!